Alternatively if you are still manually importing your bank statement, you can both use the cash application. So if you are using auto automated bank feeds, which is available for some of the banks in New Zealand. Some of the main benefits of this feature is performing cash application on imported bank lines, irrespective of method of import. You don’t need to go through and match again, because it’s already done it for you. What the automated cash application process does is attune in one step where it sends it straight to your reconciliation page, which means it disappears from your matchback data page. What that means is, once you have created the payment transactions, generally, what you would’ve had to do is go to the matchback data page and then match it against your bank statement line, and then go to your reconcile account statement page. Additionally you can auto-reconcile the customer GL payments against the imported customer payments. You can find additional invoices and also auto-apply invoices to the GL customer payments.

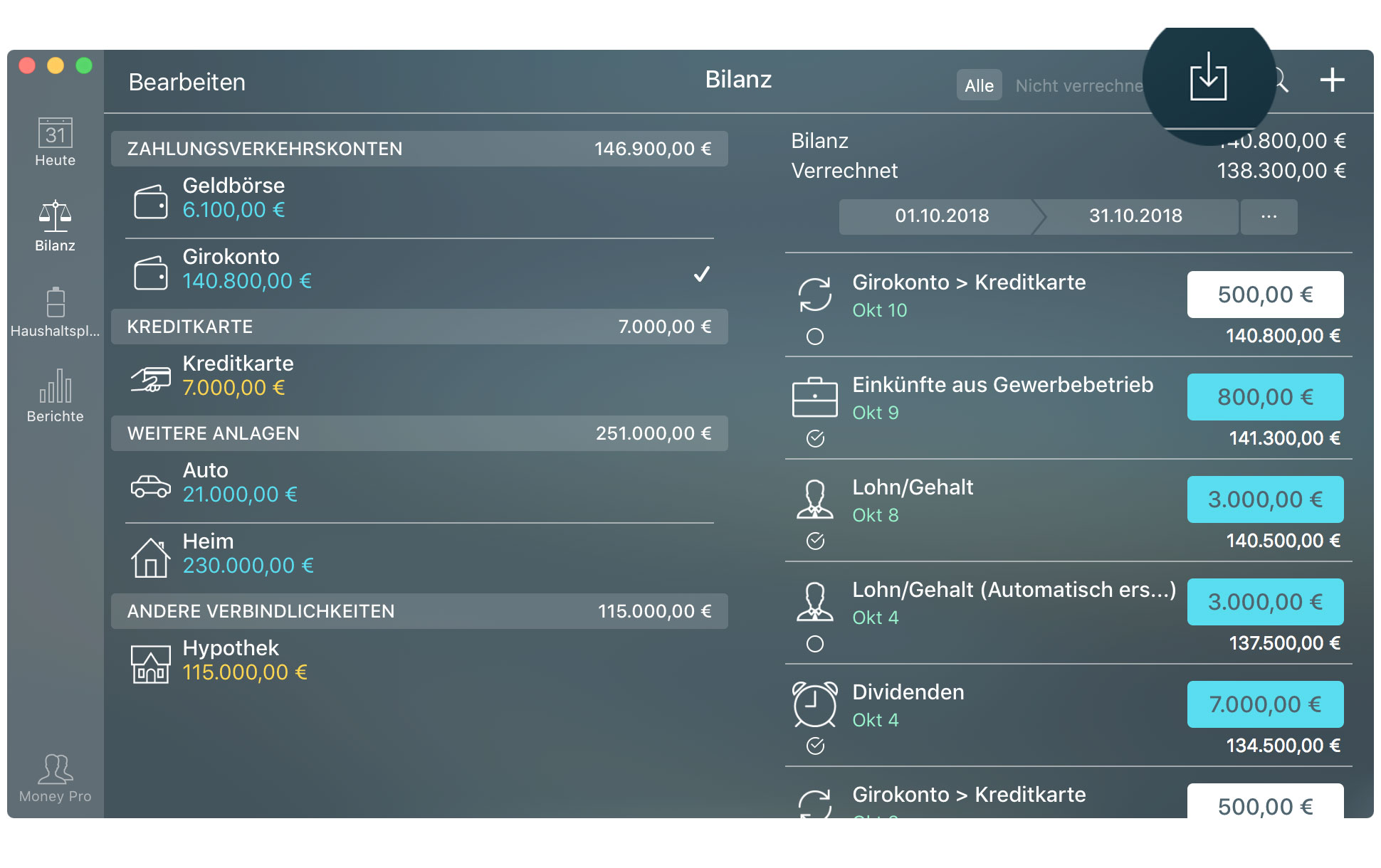

AUTOMATED MONEY PRO UPDATE

You can also edit or update cash allocation on identified invoices. Say, for example, your bank statement had a different name to what the customer was called in your account, you could set some rules around that to say, “Okay, next time you see this name in the bank statement, it belongs to customer A.”

We can also set some additional customer mapping rules. It does have some intelligent matching logic to identify the open invoices for imported customer payments. It finds and updates customers on imported payments, and then auto-generates the GL customer payments with just one click. You don’t need to move away from the screen to go and find the invoice or find the customer and then create a payment from there.

Once it performs the match, you can then submit it to create GL payments, which are automatically created and applied to the invoice which means you can do it all in one screen. When you use this feature, it automatically matches imported bank payments with open invoices in NetSuite. The Automated Cash Application feature is available to all and was released in our last 2021.2 release. It can result in your statement showing higher receivables than you actually have.Automated cash application reduces the amount of time that you need to spend on the bank reconciliation, which means you can actually do it more regularly and therefore have a more up to date cash flow statement and more up to date balance sheet as well. When this is not done in a timely manner, it affects your cashflow statement and also your balance sheet. These payments need to be matched to the appropriate invoices so that we can then clear them from the accounts receivable.

AUTOMATED MONEY PRO HOW TO

0 kommentar(er)

0 kommentar(er)